The Alliance for Entrepreneurship in Africa’s (AforE) project-driven platform has been a driving force in facilitating partnerships and collaborations among its members. One such partnership formed between the IFC and Proparco, with the goal of increasing access to sustainable trade finance in emerging African markets and promoting intra-African trade.

Through the AforE platform, this partnership has been able to take concrete actions to achieve their common goal. The first action IFC and Proparco will undertake is the establishment of a Risk Distribution Partnership. Through this partnership, Proparco will risk-participate in 50% of IFC’s Global Trade Finance Program (GTFP) exposures in selected Sub-Saharan African countries, for up to US$500 million. This collaboration will increase access to trade finance in the region and prioritize intra-Africa trade transactions, in line with IFC’s Paris Alignment Framework for financial intermediaries.

To further strengthen and support the region’s financial institutions, IFC and Proparco will jointly secure funding to expand IFC’s training and capacity-building programs for African financial institutions.

This will enhance their trade finance skills and help them meet specific transparency standards, such as detecting trade-based money laundering. Such efforts are crucial for maintaining trade and financial relations with global markets.

In addition, IFC and Proparco will also direct funding towards trade finance training programs for SME exporters and importers in low-income, fragile, and vulnerable economies. These training programs have seen significant demand, as SMEs often face high rejection rates when requesting trade finance. This initiative will support these businesses, facilitate access to trade finance in Africa, and boost intra- African trade.

Through its focus on fostering collaborations and driving meaningful change in Africa’s entrepreneurial ecosystem, AforE has been instrumental in bringing these two core members together. As the partnership continues to make strides in promoting sustainable trade finance in the region, it is a testament to the power of collaboration and the impact of AforE’s platform in driving positive change in Africa.

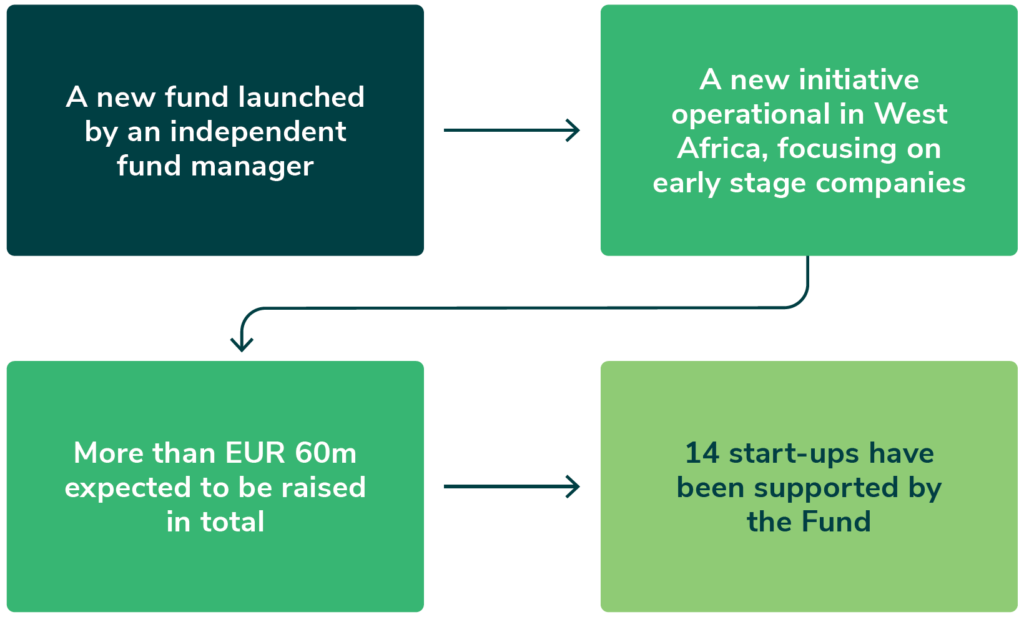

The Janngo team will implement a proactive approach to maximize value, drawing on their extensive operational experience. The Fund aims to make a significant social impact by focusing on start-ups that offer digital solutions to the population and to African SMEs, providing them affordable access to (i) markets, (ii) financial services, and (iii) tools to expand their businesses.