Africa currently faces significant challenges related to food insecurity, inflation, and heavy reliance on food imports, leading to government subsidies and depletion of foreign currency reserves. However, the continent possesses vast arable land and has the potential to produce a substantial portion of its required food, particularly in key crops such as maize, rice, and wheat. To address this, the Africa Agriculture Accelerator Program (AAAP) focuses on strengthening agricultural value chains and ecosystems through collaboration among farmers, input providers, agro-industrials, financiers, and service providers.

The emergence of AgTech companies has played a crucial role in making small-scale agriculture more profitable and attractive for commercial financing. By leveraging technology and innovative approaches, these companies have contributed to enhancing the viability and sustainability of small-scale farming operations. This, in turn, has the potential to reduce the continent’s reliance on food imports, improve food security, and alleviate the strain on government subsidies and foreign currency reserves.

The AAAP program aims to utilize IFC’s full range of products and services, such as Upstream, Advisory, and Investment, to support a network of agro-industrials and AgTechs in servicing targeted agricultural value-chains across Africa. This includes connecting them to IFC’s network of financial institutions for financing opportunities for farmers, AgTechs, off-takers, input distributors, and harvesting service providers.

The Africa Agriculture Accelerator Program (AAAP) recognizes the importance of technology and data in improving the productivity and sustainability of Africa’s agriculture. The program aims to modernize and improve the sector’s efficiency by leveraging these tools.

The program’s use of blended finance, which combines public and private sector funding, with a unique and comprehensive approach to de-risking and reducing the cost of servicing and managing financial risks in the agri value chains in Africa. This allows for a more sustainable and diverse funding model.

AAAP focuses on supporting smallholder farmers and engaging key value chain stakeholders, including AgTech companies, input suppliers, processors, and offtakers. This innovative approach drives the transition towards a more productive and sustainable agriculture system.

The program will utilize new funding instruments, such as tapping into capital markets to support climatesmart agriculture and gender initiatives. This demonstrates a forwardthinking approach to addressing critical challenges in the agriculture sector.

By freeing up public resources through the AAAP, the program has the potential to redirect these resources towards other social sectors, ultimately contributing to broader development goals.

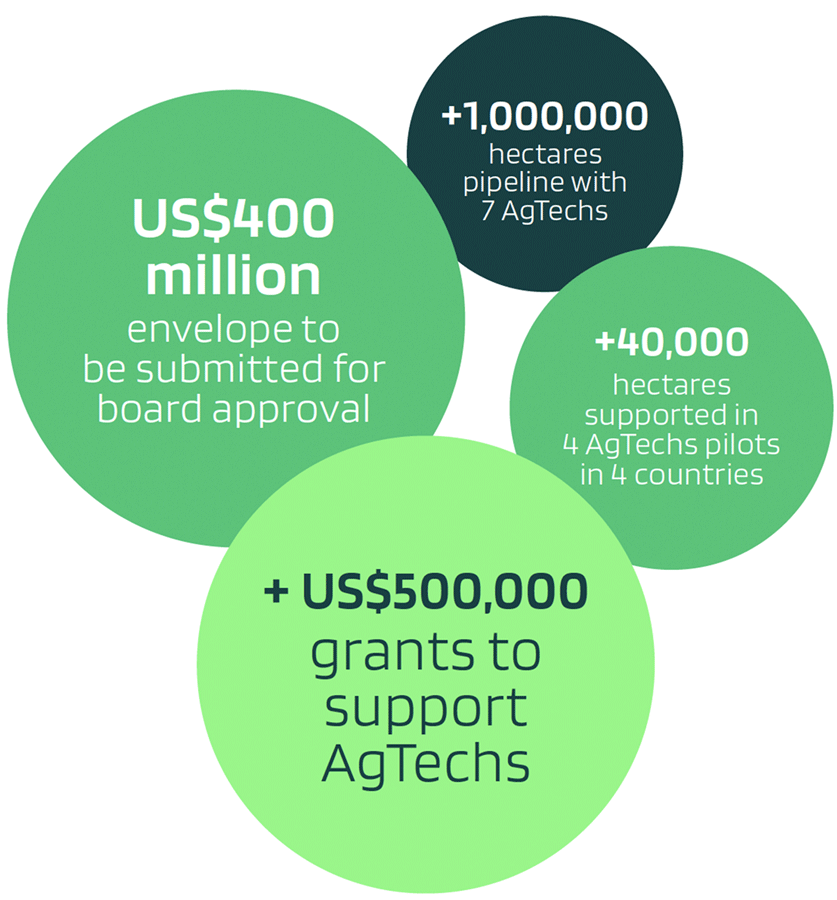

IFC is expanding its Agricultural Advisory Accelerator Program (AAAP) to 32 countries and has identified 7 AgTechs across 13 countries to help reach a goal of 1 million hectares by 2026. Pilot programs have already been launched with agCelerant, Sowit, Baba Nguna, and Kifiya in various countries and agricultural sectors.

The disruptive potential and reach of the AgTech model for agriculture in Africa can be compared to the transformative impact that Digital Financial Services have had on financial inclusion on the continent in the past decades or two.